Balancing Act: Powell’s Cautious Outlook on Rate Hikes Amid Inflation Concerns

A Cautious Approach: Powell emphasized the Federal Reserve’s careful stance in his speech. He mentioned, “given the uncertainties and risks, and how far we have come, the committee is proceeding carefully.” This signals that a rate hike in the upcoming November meeting might not be on the table.

A Balancing Act: Powell reiterated that the Federal Reserve aims to strike a balance and will be cautious about doing too much or too little. Despite the recent rapid rate hikes, more significant tightening might still be in the pipeline.

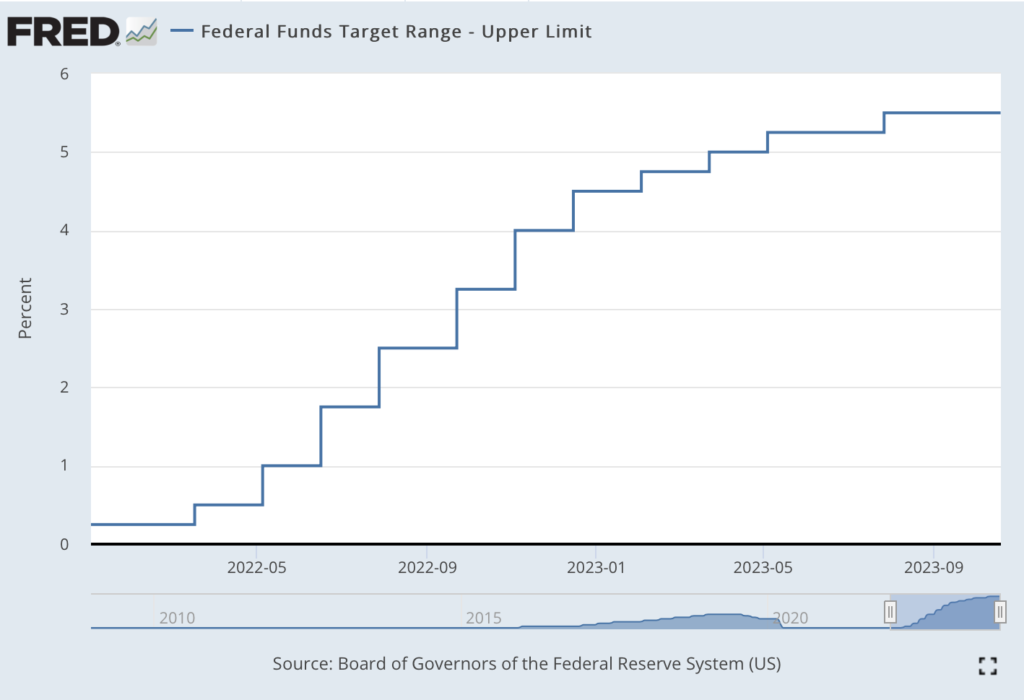

Rate Hike Expectations: Other Fed officials, in their speeches, have also been voicing the need for patience and caution while deciding the future course of interest rates. Investors are currently anticipating that the benchmark interest rate will remain within the 5.25%-5.50% bracket in November.

On Bond Yields: Powell also drew attention to the recent spike in long-term bond yields. He affirmed that if bond yields rise due to reasons other than Fed rate hike expectations, it translates to a tightening of financial conditions – exactly what the Fed is aiming for.

Inflation and Economic Health: The Fed Chair mentioned that although there was progress on the inflation front over the summer, the September data was less promising. Furthermore, core inflation rates for the recent three to six months are hovering below 3%. He also added that the job market remains robust, but signs of cooling are visible. Wage growth, as per Powell, is aligning with a 2% inflation rate over time.

Eventful Proceedings

In a noteworthy turn of events, the Manhattan gathering saw interruptions by protesters, leading to a brief escorting out of Powell before he commenced his speech. This occurrence happened just before the Fed’s upcoming 10-day blackout period, a span where public statements by Fed officials are restricted.

Last Meeting Recap

During their last policy meeting in September, the Federal Reserve maintained interest rates at a record 22-year high. They also hinted at another potential rate hike later this year to realign inflation with its 2% target.

Conclusion

While the Federal Reserve’s approach seems to be cautious and deliberate, the underlying concerns about inflation and economic conditions remain. Powell’s speech underlines the bank’s commitment to monitoring the situation and taking measured actions. With the next Federal Open Market Committee meeting scheduled for Nov. 1, all eyes are on the Federal Reserve and their consequential decisions.

About

David Coggins is an independent writer informing readers about local business news. He has no affiliation with the business or organization featured in this story. Send inquiries, info, or corrections to info@davidcoggins.blog. You can also contact him through the sites contact page.

Follow David on Medium.com, Newsbreak.com or his personal blog for more stories on the economy, news, business, finance, artificial intelligence, and more.